Could nonprofits suffer a loss of image – and charitable giving — by being confused with the “social welfare organizations” designed to funnel contributions into electing politicians and affecting legislation?

I am concerned.

If you are like me, you have been turned down for a charitable gift by a donor prospect who is “tapped out” from the political election cycle.

The number of nonprofit appeals fall short of solicitations from PACs, politicians and your political party affiliation by about twenty to one.

Not only is the onslaught of political fundraising appeals increasing, the dramatic urgency of their messages drives you to the “donate now” page with an urgency that only natural disasters do for nonprofits.

Here’s a disturbing truth: We will never know how much of the money flowing into politics might have gone to philanthropy.

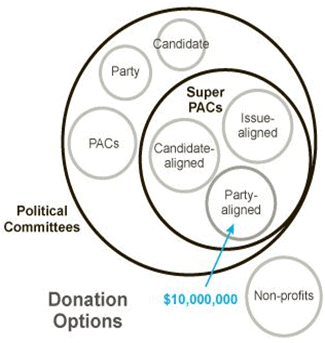

The Supreme Court’s Citizens United decision dramatically changed the giving landscape and rules. Under the ruling, 501(c)4 nonprofits can spend an unlimited amount on independent expenditures and electioneering communications without disclosing the names of their donors or the amounts they gave. In the 2012 campaign, these “dark money” expenditures exceeded $300 million.

These groups are on track to far outpace this number in the 2016 race. In 2012, $180 million was raised solely to oppose President Barack Obama’s re-election; in 2016, we have already seen untold sums spent on defeating Republican candidate Donald Trump in the primary election. In the 2016 race, social welfare nonprofits are spending more money on television advertising than any other type of independent group.

The American tax code allows non-profit groups with political operations to spend undisclosed millions of dollars for political campaigns. The IRS has abandoned efforts to force major donors to pay gift tax on contributions to social welfare nonprofits heavily involved in politics. When donors don’t have to pay a gift tax, do they equate such gifts as the same as a gift to a bona fide charity?

More troubling: the IRS defines a social welfare organization as an entity primarily engaged in promoting the common good and general welfare of the people of the community, with a purpose to bring about “civic betterment and social improvements.” This fuzzy line leaves “civic betterment” up to each individual’s interpretation and does nothing to distinguish these organizations from true charities.

It gets even stickier: many politically active nonprofits coordinate their efforts, passing large amounts of money from one to another. In doing this, they claim to be fulfilling their “social welfare” mandate. Moreover, these “social welfare” groups sometimes report different numbers to the IRS and FEC.

Donors who give to these nonprofit social welfare organizations likely feel as if they are giving to the common good and general welfare of the community. But very little of their generosity is going to actual programs and services that benefit the recipients of the charity’s work.

As non-profit professionals, we should be alert to this trend and asking ourselves important questions:

- As money is steered toward election spending, how will giving to non-profit programs and operations be affected?

- As more money is put into the political process at all levels, at what point will individuals justify moving their charitable contributions to political candidates?

- Will a political contribution seem to have a greater personal ROI than a charitable gift (given that the tax deduction is not an important driver for most donors)?

Until there is more transparency, we will never know the answers to these questions.

At the very worse, this trend could lead to a loss of faith in the non-profit sector, as it confuses giving to true charitable programs.

In the 2016 election, the American electorate is speaking out. American donors might end up speaking out as well, in the form of a tragic loss of faith in our country’s most coveted tradition – our charitable sector.

Ready to get started on reaching your potential? Contact us to get started.